Thursday, 29 December 2016

FT:

2016 in review: the big events, your top picks, reviews and people

{https://www.ft.com/content/5169b9ba-c91a-11e6-9043-7e34c07b46ef}

comedy

Bullseye

2016

http://www.maximumfun.org/bullseye/bullseye-jesse-thorn-end-year-2016-comedy-special

2015

http://www.maximumfun.org/bullseye/best-comedy-2015-special

round the world in 48days

http://www.yachtingworld.com/news/coville-sets-incredible-new-49-day-solo-round-the-world-record-with-a-blistering-average-speed-of-23-knots-102483

Tuesday, 20 December 2016

sure we'll see this again in years to come

The 50 funniest films… chosen by comedians

{https://www.theguardian.com/film/2016/dec/18/the-50-funniest-comedy-films-chosen-comedians-stewart-lee-sarah-millican-david-baddiel}

The 50 funniest films… chosen by comedians

{https://www.theguardian.com/film/2016/dec/18/the-50-funniest-comedy-films-chosen-comedians-stewart-lee-sarah-millican-david-baddiel}

Monday, 19 December 2016

Preparing for Brentry – after Brexit: A view from Sweden

{http://voxeu.org/article/preparing-brentry-after-brexit-view-sweden}

Tuesday, 29 November 2016

life hack

Spend the First Hour of the Day on Activities That Add Value to Your Life

{https://medium.com/the-mission/spend-the-first-hour-of-the-day-on-activities-that-add-value-to-your-life-1968902c32a5#.4b73duwo8}

Paul Krugman: Why Corruption Matters

{http://economistsview.typepad.com/economistsview/2016/11/paul-krugman-why-corruption-matters.html}

How the global Left destroyed itself (or, all sex is not rape)

{http://www.macrobusiness.com.au/2016/11/global-left-destroyed-sex-not-rape/}

snoop poop

These Are The 48 Organizations That Now Have Access To Every Brit's Browsing History

{http://www.zerohedge.com/news/2016-11-26/these-are-48-organizations-now-have-access-every-brits-browsing-history}

Exploding myths about the gig economy

{http://voxeu.org/article/exploding-myths-about-gig-economy}

Spend the First Hour of the Day on Activities That Add Value to Your Life

{https://medium.com/the-mission/spend-the-first-hour-of-the-day-on-activities-that-add-value-to-your-life-1968902c32a5#.4b73duwo8}

Paul Krugman: Why Corruption Matters

{http://economistsview.typepad.com/economistsview/2016/11/paul-krugman-why-corruption-matters.html}

How the global Left destroyed itself (or, all sex is not rape)

{http://www.macrobusiness.com.au/2016/11/global-left-destroyed-sex-not-rape/}

snoop poop

These Are The 48 Organizations That Now Have Access To Every Brit's Browsing History

{http://www.zerohedge.com/news/2016-11-26/these-are-48-organizations-now-have-access-every-brits-browsing-history}

Exploding myths about the gig economy

{http://voxeu.org/article/exploding-myths-about-gig-economy}

Tuesday, 22 November 2016

Monday, 21 November 2016

Wednesday, 9 November 2016

The disappearing middle class, and a nation, on the brink

and

Written in advance

5 Reasons Why Trump Will Win

This wretched, ignorant, dangerous part-time clown and full time sociopath is going to be our next president.

http://michaelmoore.com/trumpwillwin/

{http://www.mirror.co.uk/news/uk-news/3-bits-bad-news-tories-9219925}

Monday, 7 November 2016

longer reads for later

How Sociopathic Capitalism Came to Rule the World

http://www.theatlantic.com/business/archive/2016/11/sociopathic-capitalism/506240/

The Script of a Real-Life Tragedy

http://www.spiegel.de/international/world/us-presidential-campaign-concludes-in-farce-a-1119830.html

Thursday, 3 November 2016

The fatal flaw of the populist approach

http://www.irisheconomy.ie/index.php/2016/11/01/the-fatal-flaw-of-the-populist-approach/

The problem with low interest rates

http://monevator.com/the-problem-with-low-interest-rates/

Wednesday, 2 November 2016

The fundamental factors behind the Brexit vote

{http://voxeu.org/article/fundamental-factors-behind-brexit-vote}

Tuesday, 1 November 2016

Theresa May lied and lied again to become PM

https://www.theguardian.com/commentisfree/2016/oct/30/theresa-may-lie-and-lied-to-become-prime-minister

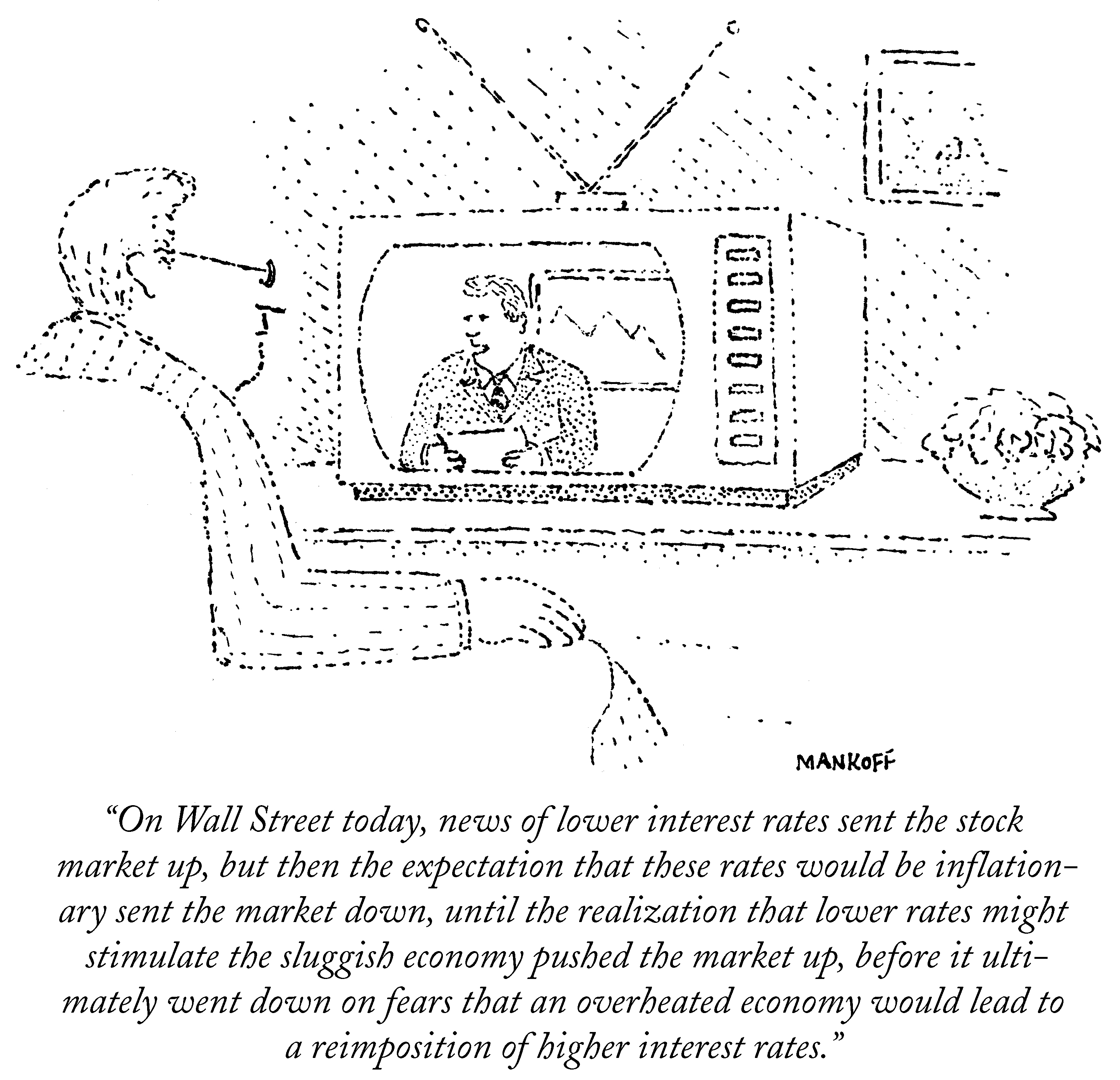

Faulty Wall Street Assumptionshttp://awealthofcommonsense.com/2016/10/faulty-wall-street-assumptions/

Five steps to being fully present in the moment

hommm

Wednesday, 19 October 2016

want: boxofcrap

https://shift.newco.co/what-50-buys-you-at-huaqiangbei-the-worlds-most-fascinating-electronics-market-f0384d9fca32#.ytxpgmpqc

The Dying Business of Picking Stocks

http://www.wsj.com/articles/the-dying-business-of-picking-stocks-1476714749

http://www.wsj.com/articles/the-dying-business-of-picking-stocks-1476714749

Friday, 14 October 2016

After Brexit, our tabloid newspapers are taking political intolerance to a chilling new extreme

These newspapers and their commentators are now implying that those who disagree with them should be silenced, or even locked up. This is dark and dangerous territory

http://www.independent.co.uk/voices/daily-mail-brexit-daily-express-the-sun-tabloids-language-political-intolerance-traitors-a7357591.html

Blockchain settlement

http://streetwiseprofessor.com/?p=10201

Five Books to Change Liberals' Mindshttps://www.bloomberg.com/view/articles/2016-10-11/five-books-to-change-liberals-minds

Wednesday, 12 October 2016

Battle for AleppoHow Syria Became the New Global War

http://www.spiegel.de/international/world/syria-war-became-conflict-between-usa-and-russia-and-iran-a-1115681.html

Simon English: Bankers heading off to Frankfurt? It's just a fantasy

Monday, 10 October 2016

Super Size farming

http://www.nytimes.com/interactive/2016/10/09/magazine/big-food-photo-essay.html?rref=collection%2Fsectioncollection%2Fmagazine&_r=0

Paul Krugman: What About the Planet?

http://economistsview.typepad.com/economistsview/2016/10/paul-krugman-what-about-the-planet.html

http://www.nytimes.com/interactive/2016/10/09/magazine/big-food-photo-essay.html?rref=collection%2Fsectioncollection%2Fmagazine&_r=0

Paul Krugman: What About the Planet?

http://economistsview.typepad.com/economistsview/2016/10/paul-krugman-what-about-the-planet.html

Friday, 7 October 2016

ON £ MOVE

But some foolish folk will have done a Bloomberg News search for GBP and decided that it is due to the news that fracking had been allowed in North West England. Which is of course rubbish, because we all know that it happened because Diane Abbott was made the shadow Home Secretary.http://polemics-pains.blogspot.co.uk/2016/10/gbp-goes-eurchf-whats-going-on.html

Thursday, 6 October 2016

Your name will also go on the list

http://www.economist.com/blogs/buttonwood/2016/10/british-economic-policy

But this was not the only bad idea to come out of the current Conservative conference. First, there was the idea of training more British doctors so that foreign doctors could “go home” after 2025, a policy hardly designed to engender confidence in the many immigrants (like my GP and dentist) who keep the health service going. Then there was the idea oflimiting the number of foreign students who can come to British universities (another brainwave from Ms Rudd).

Wednesday, 5 October 2016

Yikes, foreign workers..

http://ftalphaville.ft.com/2016/10/05/2176612/fessing-up-to-foreign-workers/#respond

still about porn

http://dealbreaker.com/2016/10/what-awaits-you-behind-that-headset-is-the-future/

http://ftalphaville.ft.com/2016/10/05/2176612/fessing-up-to-foreign-workers/#respond

still about porn

http://dealbreaker.com/2016/10/what-awaits-you-behind-that-headset-is-the-future/

Tuesday, 27 September 2016

The Penny Stock Chronicles

{https://theintercept.com/2016/09/23/big-players-little-stocks-and-naked-shorts/}

Brexit is like when Henry VIII told the Pope to go f*** himself. - Nomura

{http://www.telegraph.co.uk/business/2016/09/25/did-henry-viiis-tudor-brexit-lead-to-englands-trading-glory-or-a/?curator=thereformedbroker&utm_source=thereformedbroker}

The City will decline—and we will be the poorer for it

{http://bruegel.org/2016/09/the-city-will-decline-and-we-will-be-the-poorer-for-it/}

The diminishing returns of blockchain fetishism

{http://ftalphaville.ft.com/2016/09/27/2175973/the-diminishing-returns-of-blockchain-fetishism/}

{https://theintercept.com/2016/09/23/big-players-little-stocks-and-naked-shorts/}

Brexit is like when Henry VIII told the Pope to go f*** himself. - Nomura

{http://www.telegraph.co.uk/business/2016/09/25/did-henry-viiis-tudor-brexit-lead-to-englands-trading-glory-or-a/?curator=thereformedbroker&utm_source=thereformedbroker}

The City will decline—and we will be the poorer for it

{http://bruegel.org/2016/09/the-city-will-decline-and-we-will-be-the-poorer-for-it/}

The diminishing returns of blockchain fetishism

{http://ftalphaville.ft.com/2016/09/27/2175973/the-diminishing-returns-of-blockchain-fetishism/}

Thursday, 22 September 2016

How to hide it: inside the secret world of wealth managers

https://www.theguardian.com/business/2016/sep/21/how-to-hide-it-inside-secret-world-of-wealth-managers

Tuesday, 20 September 2016

Wednesday, 14 September 2016

If You Build It . . .

http://www.city-journal.org/html/if-you-build-it-14606.html

Mythbusting Uber’s valuation

http://ftalphaville.ft.com/2016/09/13/2173631/mythbusting-ubers-valuation/

Don’t believe the good news about Brexit

http://marginalrevolution.com/marginalrevolution/2016/09/dont-believe-good-news-brexit.html

Friday, 9 September 2016

BASE

When it starts to stall, it loses lift, starts to drag, and then, splat.

http://www.nationalgeographic.com/adventure/activities/aerial-sports/why-are-so-many-base-jumpers-dying/

A Dozen Things I’ve Learned About the Music Business (and Businesses Like It)

https://25iq.com/2016/09/03/a-dozen-things-ive-learned-about-the-music-business-and-businesses-like-it/

Thursday, 11 August 2016

Are market efficient?

29:30 : They are all lineal combinations of various multistate combinations

Do market prices generally reflect all available information? Or are they prone to bubbles? On this episode of The Big Question, two members of the Chicago Booth faculty—Nobel laureate Eugene F. Fama and Richard H. Thaler, the father of behavioral economics—discuss how markets behave (and misbehave). Along the way they discuss value stocks versus growth stocks, the existence of economic bubbles, and the curious case of the CUBA Fund

29:30 : They are all lineal combinations of various multistate combinations

Wednesday, 10 August 2016

The End of the Angry Guitar

http://www.thedailybeast.com/articles/2016/08/07/the-end-of-the-angry-guitar.html

I’m a neoliberal. Maybe you are toohttps://medium.com/@s8mb/im-a-neoliberal-maybe-you-are-too-b809a2a588d6#.fzcqvvclr

Thursday, 14 July 2016

Gaiety is a quality of ordinary people. Genius presupposes some disorder in the machineDenis Diderot

Friday, 8 July 2016

Just Say No to High-Speed Rail

http://www.bloomberg.com/view/articles/2016-07-07/just-say-no-to-high-speed-rail

Why Traders Have Lost Their Touch

http://www.bloomberg.com/view/articles/2016-07-08/why-today-s-traders-have-lost-their-touch

Thursday, 7 July 2016

Why a weaker pound won’t help the UK so much?http://marginalrevolution.com/marginalrevolution/2016/07/why-a-weaker-pound-wont-help-the-uk-so-much.html

from herehttp://www.georgemagnus.com/ftse-isnt-telling-us-anything-about-the-post-brexit-world-but-is/

from herehttp://www.georgemagnus.com/ftse-isnt-telling-us-anything-about-the-post-brexit-world-but-is/

Wednesday, 6 July 2016

https://mainlymacro.blogspot.co.uk/2016/07/more-on-how-it-happened.html

Tuesday, 5 July 2016

Didn’t the Sex Pistols sing about “…now I got a reason to be waiting”?

When will the United Kingdom invoke Article 50?

http://marginalrevolution.com/marginalrevolution/2016/07/when-will-the-united-kingdom-invoke-article-50.html

Monday, 4 July 2016

social terrorism through wine

'Everything with wine is subjective. There are no rights or wrongs in wine appreciation, and, as one would expect with anything that involves the palate and sensitivity to various different compounds and like and dislikes, we do vary. I’ve never tried to give the impression that my opinion is the one and only one. I just say what I think, and my whole career has been dedicated to trying to give consumers enough confidence to make up their own minds'

http://fivebooks.com/interview/jancis-robinson-wine/

'Everything with wine is subjective. There are no rights or wrongs in wine appreciation, and, as one would expect with anything that involves the palate and sensitivity to various different compounds and like and dislikes, we do vary. I’ve never tried to give the impression that my opinion is the one and only one. I just say what I think, and my whole career has been dedicated to trying to give consumers enough confidence to make up their own minds'

http://fivebooks.com/interview/jancis-robinson-wine/

Thursday, 30 June 2016

Monday, 27 June 2016

maybe the only upside is trump won't get in

http://www.businessinsider.com/leave-voters-are-not-stupid-2016-6

The Frightening Global Rise of Agnotology

http://www.bloomberg.com/view/articles/2016-06-27/culturally-constructed-ignorance-wins-the-day

http://www.businessinsider.com/leave-voters-are-not-stupid-2016-6

IT WAS a troubling exchange. On live television Faisal Islam, the political editor of SkyNews, was recounting a conversation with a pro-Brexit Conservative MP. “I said to him: ‘Where’s the plan? Can we see the Brexit plan now?’ [The MP replied:] ‘There is no plan. The Leave campaign don’t have a post-Brexit plan…Number 10 should have had a plan.’” The camera cut to Anna Botting, the anchor, horror chasing across her face. For a couple of seconds they were both silent, as the point sunk in. “Don’t know what to say to that, actually,” she replied, looking down at the desk. Then she cut to a commercial break.http://www.economist.com/blogs/bagehot/2016/06/anarchy-uk

The Frightening Global Rise of Agnotology

http://www.bloomberg.com/view/articles/2016-06-27/culturally-constructed-ignorance-wins-the-day

Wednesday, 22 June 2016

Monday, 20 June 2016

Thursday, 16 June 2016

Brexit and democracy

https://mainlymacro.blogspot.co.uk/2016/06/brexit-and-democracy.html

All You Need To Know About the UK Referendum

http://www.spiegel.de/international/europe/all-you-need-to-know-about-the-brexit-referendum-in-the-uk-a-1097629.html

http://www.spiegel.de/politik/ausland/comment-on-brexit-it-s-smarter-to-stay-a-1096929.html

The centre-left’s obsession with “electability” – a word that has become a whine of over-entitled narcissists.

http://stumblingandmumbling.typepad.com/

https://mainlymacro.blogspot.co.uk/2016/06/brexit-and-democracy.html

All You Need To Know About the UK Referendum

http://www.spiegel.de/international/europe/all-you-need-to-know-about-the-brexit-referendum-in-the-uk-a-1097629.html

http://www.spiegel.de/politik/ausland/comment-on-brexit-it-s-smarter-to-stay-a-1096929.html

The centre-left’s obsession with “electability” – a word that has become a whine of over-entitled narcissists.

http://stumblingandmumbling.typepad.com/

Monday, 13 June 2016

Wednesday, 8 June 2016

Monday, 6 June 2016

Wednesday, 1 June 2016

rps beaten

http://boingboing.net/2016/05/31/how-to-outguess-multiple-choic.html

My worries about Singapore

http://marginalrevolution.com/marginalrevolution/2016/06/my-worries-about-singapore.html

Crashes, Terrorists, Sharks – Oh, My!

http://ritholtz.com/2016/06/crashes-terrorists-sharks-oh-my-2/

Friday, 27 May 2016

Friday, 20 May 2016

Wednesday, 11 May 2016

Tuesday, 10 May 2016

That’s why this is called hyperbolic discounting

MIT Courses

http://ocw.mit.edu/courses/#economics

Some thoughts on the end of economic growth

http://timothyblee.com/2016/05/07/some-thoughts-on-the-end-of-economic-growth/

MIT Courses

http://ocw.mit.edu/courses/#economics

Some thoughts on the end of economic growth

http://timothyblee.com/2016/05/07/some-thoughts-on-the-end-of-economic-growth/

Monday, 9 May 2016

Solar

3 U.S. cents per kilowatt-hour (kWh)http://www.macrobusiness.com.au/2016/05/solar-cheaper-than-fossil-fuels-in-middle-east/

3 U.S. cents per kilowatt-hour (kWh)http://www.macrobusiness.com.au/2016/05/solar-cheaper-than-fossil-fuels-in-middle-east/

Wednesday, 4 May 2016

Professor Fama: How Markets Really Work

{http://ritholtz.com/2016/05/professor-fama-how-markets-really-work/}

Bill Sharpe, The Arithmetic of Active Management

'In aggregate active investors hold the market portfolio, so if some skilled active investors overweight an undervalued stock, other active investors must underweight it. This means that, before fees and expenses, trading is a zero sum game. Ignoring costs, the gains of the skilled investors are, dollar for dollar, at the expense of other investors.'

{https://www.dimensional.com/famafrench/essays/why-active-investing-is-a-negative-sum-game.aspx}

{http://ritholtz.com/2016/05/professor-fama-how-markets-really-work/}

Bill Sharpe, The Arithmetic of Active Management

'In aggregate active investors hold the market portfolio, so if some skilled active investors overweight an undervalued stock, other active investors must underweight it. This means that, before fees and expenses, trading is a zero sum game. Ignoring costs, the gains of the skilled investors are, dollar for dollar, at the expense of other investors.'

{https://www.dimensional.com/famafrench/essays/why-active-investing-is-a-negative-sum-game.aspx}

Friday, 29 April 2016

Stuck on repeat: why we love repetition in music

http://www.theguardian.com/music/2016/apr/29/why-we-love-repetition-in-music-tom-service

http://www.theguardian.com/music/2016/apr/29/why-we-love-repetition-in-music-tom-service

Wednesday, 27 April 2016

Leicester City: Dirty Dozen or Harvard Case Study?

http://www.bloombergview.com/articles/2016-04-26/leicester-city-dirty-dozen-or-harvard-case-study

Friday, 22 April 2016

The Greatest Poet Alive

http://www.theatlantic.com/magazine/archive/2016/05/the-greatest-poet-alive/476376/

Singapore

http://www.theguardian.com/cities/2016/apr/21/story-cities-singapore-carefully-planned-lee-kuan-yew

Why Haven’t Bankers Been Punished? Just Read These Insider SEC Emails

https://www.propublica.org/article/why-havent-bankers-been-punished-just-read-these-insider-sec-emails

Wednesday, 20 April 2016

Offshore in central London: the curious case of 29 Harley Street

http://www.theguardian.com/business/2016/apr/19/offshore-central-london-curious-case-29-harley-street

Top ten trends in Fintech

http://www.futuresmag.com/2016/04/15/top-10-trends-fintech

What the great degree rip-off means for graduates: low pay and high debt

http://www.theguardian.com/commentisfree/2016/apr/19/degree-graduates-low-pay-high-debt-students

good points against a 'Brexit'

https://medium.com/@DuncanWeldon/brexit-the-trade-deficit-is-not-a-source-of-strength-345f88026723#.6gjmupa5s

The whole point of the debate at the moment is that we know — at least in the short term — what Remain looks like, we don’t know what Leave looks like. That creates the kind of uncertainty which delays investment decisions and which would get worse after a Leave vote as we entered into months or years of talks.

And it’s this uncertainty which takes me to my biggest problem with the “the trade deficit is a strength” argument. It ignores the elephant in the room which the large UK’s current account deficit

That to me, is the best economic argument against a Leave vote — why trigger an event that could lead to a reassessment of UK risks by global investors when you are “dependent to the kindness of strangers” for funding?

Tuesday, 19 April 2016

FT on Bullshit

http://www.ft.com/cms/s/2/2e43b3e8-01c7-11e6-ac98-3c15a1aa2e62.html?siteedition=uk

Such careful statistical spin-doctoring might seem a world away from Trump’s reckless retweeting of racially charged lies. But in one sense they were very similar: a political use of statistics conducted with little interest in understanding or describing reality

Monday, 18 April 2016

Thursday, 14 April 2016

Impartial coverage of the Brexit and Bremain navies.

{http://mainlymacro.blogspot.co.uk/2016/04/the-eu-referendum-and-media.html}

and

{http://www.theguardian.com/commentisfree/2016/apr/01/bbc-brexit-too-timid-impartial-on-eu-not-enough?CMP=twt_gu}

{http://mainlymacro.blogspot.co.uk/2016/04/the-eu-referendum-and-media.html}

and

{http://www.theguardian.com/commentisfree/2016/apr/01/bbc-brexit-too-timid-impartial-on-eu-not-enough?CMP=twt_gu}

Wednesday, 13 April 2016

25 Incredibly Useful Free Sites And Services

http://www.fastcompany.com/3058645/25-incredibly-useful-free-sites-and-services/9

Tuesday, 12 April 2016

The epistolary novel that is this blob....

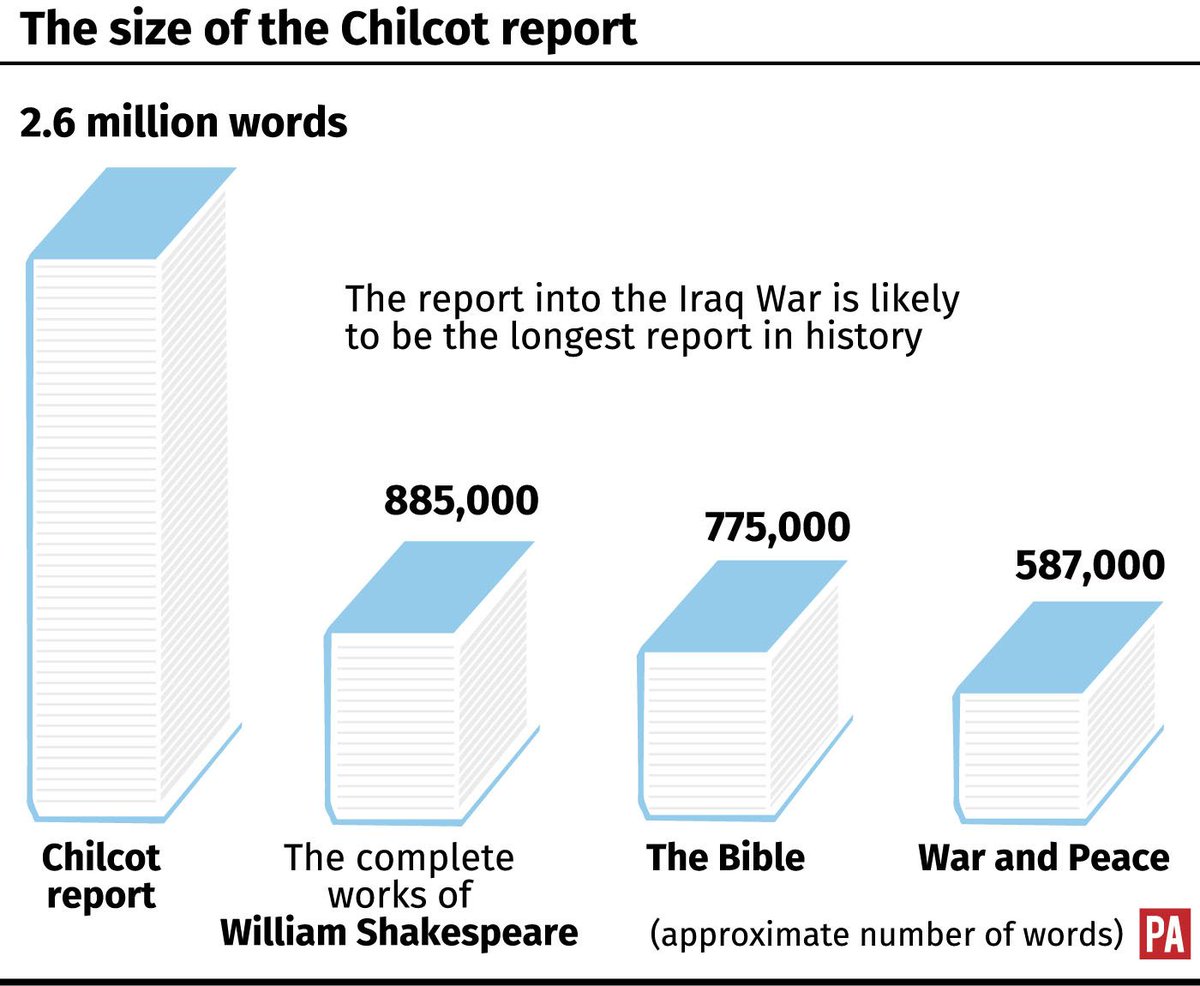

Salman Rushdie: how Cervantes and Shakespeare wrote the modern literary rule book

http://www.newstatesman.com/culture/books/2016/04/salman-rushdie-how-cervantes-and-shakespeare-wrote-modern-literary-rule-book

Panama Papers

The 1% hide their money offshore – then use it to corrupt our democracyhttp://www.theguardian.com/news/commentisfree/2016/apr/10/money-offshore-corrupt-democracy-political-influence

Salman Rushdie: how Cervantes and Shakespeare wrote the modern literary rule book

http://www.newstatesman.com/culture/books/2016/04/salman-rushdie-how-cervantes-and-shakespeare-wrote-modern-literary-rule-book

Panama Papers

The 1% hide their money offshore – then use it to corrupt our democracyhttp://www.theguardian.com/news/commentisfree/2016/apr/10/money-offshore-corrupt-democracy-political-influence

Wednesday, 6 April 2016

Panama

Panama Papers The Power Players {https://projects.icij.org/panama-papers/power-players/}

{http://www.theguardian.com/news/2016/apr/05/panama-papers-pull-fifa-uefa-chief-gianni-infantino-corruption-scandal}

{http://www.theguardian.com/news/2016/apr/05/panama-papers-world-leaders-tycoons-secret-property-empires}

The Panama Papers’ Sprawling Web of Corruption

{http://www.nytimes.com/2016/04/06/opinion/the-panama-papers-sprawling-web-of-corruption.html?_r=0}

{http://www.theguardian.com/news/2016/apr/05/panama-papers-pull-fifa-uefa-chief-gianni-infantino-corruption-scandal}

{http://www.theguardian.com/news/2016/apr/05/panama-papers-world-leaders-tycoons-secret-property-empires}

The Panama Papers’ Sprawling Web of Corruption

{http://www.nytimes.com/2016/04/06/opinion/the-panama-papers-sprawling-web-of-corruption.html?_r=0}

Tuesday, 5 April 2016

Monday, 29 February 2016

Blockchain and the holy real-time settlement grail

http://ftalphaville.ft.com/2016/02/26/2154510/blockchain-and-the-holy-real-time-settlement-grail/

http://ftalphaville.ft.com/2016/02/26/2154510/blockchain-and-the-holy-real-time-settlement-grail/

Friday, 26 February 2016

Wednesday, 24 February 2016

Bitcoin the sewer rat

http://boingboing.net/2016/02/22/bitcoin-is-the-sewer-rat-of-cu.html

http://boingboing.net/2016/02/22/bitcoin-is-the-sewer-rat-of-cu.html

Tuesday, 23 February 2016

What will P2P lending look like 5 years from now?

http://ftalphaville.ft.com/2015/02/19/2119569/what-will-p2p-lending-look-like-5-years-from-now/

'The really interesting thing about the potential for P2P to displace traditional banks and their clones is that it shows how easy it is to separate the business of taking deposits and running the payments system from the fundamentally unrelated business of allocating credit. Banks like combining these business lines to extract rents from the rest of society but there isn’t really any good reason why we let them do it. (Also, it’s not even clear they do a particularly good job at allocating credit to productive investments.)'

The worrying signal from US online lending

{http://ftalphaville.ft.com/2016/02/22/2153904/the-worrying-signal-from-us-online-lending/}

Monday, 15 February 2016

Help to Buy? More like Help to Cry for London’s first-time buyers

{http://www.ft.com/cms/s/0/0989bc0c-d0b0-11e5-831d-09f7778e7377.html#axzz40FCwNGnM}

Thursday, 11 February 2016

Monopoly spoiled {http://imgur.com/topic/The_More_You_Know/vX3zm}

and

Monopoly Ultimate Banking Eliminates Cash With a Tiny ATM That Scans Property Cards

{http://toyland.gizmodo.com/monopoly-ultimate-banking-eliminates-cash-with-a-tiny-a-1759240688}

and

Monopoly Ultimate Banking Eliminates Cash With a Tiny ATM That Scans Property Cards

{http://toyland.gizmodo.com/monopoly-ultimate-banking-eliminates-cash-with-a-tiny-a-1759240688}

Friday, 5 February 2016

Unobtainium

The Elements of Power: Gadgets, Guns, and the Struggle for a Sustainable Future in the Rare Metal Age

{https://literaryreview.co.uk/unobtainium}

The Elements of Power: Gadgets, Guns, and the Struggle for a Sustainable Future in the Rare Metal Age

{https://literaryreview.co.uk/unobtainium}

Thursday, 4 February 2016

Broader questions to be asked about the efficacy of capitalism...

Goldman Sachs Says It May Be Forced to Fundamentally Question How Capitalism Is Working

{http://www.bloomberg.com/news/articles/2016-02-03/goldman-sachs-says-it-may-be-forced-to-fundamentally-question-how-capitalism-is-working}

The NIM force awakens ft

Photographer: Jasper Juinen/Bloomberg

{http://www.bloomberg.com/news/articles/2016-02-03/goldman-sachs-says-it-may-be-forced-to-fundamentally-question-how-capitalism-is-working}

The NIM force awakens ft

So what the hell is going on? Is capitalism broken? Or is the simpler answer that global capital availability isn’t what we thought it was?Is the capital stock we think we have actually illusion? And does negative NIM represent not a capital glut …. but perhaps weirdly enough the exact opposite: a large liquid layer atop a very slim capital share?Perhaps what’s really been happening is that the digitisation of the market since the 1980s has led to the creation of a Gosplan 2.0 mechanism for the world? Which is to say, market signals have been entirely contaminated by the digital sector’s obsession with “eco-systems” and conglomerisation — a Silicon Valley euphemism for cross-subsidisation.If that’s true, it’s entirely possible the cost of essential goods (internet, telecoms, base foods, base clothes, base transport) has been massively underpriced for years versus their true cost of production at the same that the price of quality goods has been entirely overpriced versus their cost of production as well?

Tuesday, 2 February 2016

Wednesday, 27 January 2016

Monday, 18 January 2016

Howard Marks update

Vilfredo Pareto’s assertion that “the foundation of political economy and, in general, of every social science, is evidently psychology.

https://www.oaktreecapital.com/insights/howard-marks-memos?curator=thereformedbroker&utm_source=thereformedbroker

big short

{http://www.politico.com/magazine/story/2016/01/what-the-big-short-gets-wrong-213535}

Improve your sat score

{http://www.vox.com/2016/1/8/10728958/sat-tutor-expensive}

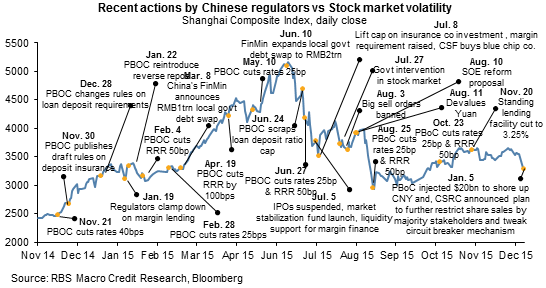

Chinese debt

{http://www.bloomberg.com/news/articles/2016-01-14/a-towering-chinese-debt-mountain-looms-behind-market-gyrations}

how to behave in a crash

{https://www.washingtonpost.com/business/get-there/the-dos-and-donts-of-a-market-crash/2016/01/08/8dd9bf72-b2f9-11e5-a842-0feb51d1d124_story.html}

truth behind coming a trader

{http://www.theage.com.au/money/investing/the-truth-behind-courses-on-how-to-be-a-trader-20160104-glysz1.html}

learning source, cost of capital

{http://www.valuewalk.com/2016/01/january-2016-data-update-4-costs-capital/}

Vilfredo Pareto’s assertion that “the foundation of political economy and, in general, of every social science, is evidently psychology.

https://www.oaktreecapital.com/insights/howard-marks-memos?curator=thereformedbroker&utm_source=thereformedbroker

big short

{http://www.politico.com/magazine/story/2016/01/what-the-big-short-gets-wrong-213535}

Improve your sat score

{http://www.vox.com/2016/1/8/10728958/sat-tutor-expensive}

Chinese debt

{http://www.bloomberg.com/news/articles/2016-01-14/a-towering-chinese-debt-mountain-looms-behind-market-gyrations}

how to behave in a crash

{https://www.washingtonpost.com/business/get-there/the-dos-and-donts-of-a-market-crash/2016/01/08/8dd9bf72-b2f9-11e5-a842-0feb51d1d124_story.html}

truth behind coming a trader

{http://www.theage.com.au/money/investing/the-truth-behind-courses-on-how-to-be-a-trader-20160104-glysz1.html}

learning source, cost of capital

{http://www.valuewalk.com/2016/01/january-2016-data-update-4-costs-capital/}

Monday, 11 January 2016

A short history of the Bowie Bond

{http://ftalphaville.ft.com/2016/01/11/2149761/a-short-history-of-the-bowie-bond/}

What is going on in China right now?

{http://ftalphaville.ft.com/2016/01/11/2149761/a-short-history-of-the-bowie-bond/}

{http://ftalphaville.ft.com/2016/01/11/2149761/a-short-history-of-the-bowie-bond/}

What is going on in China right now?

{http://ftalphaville.ft.com/2016/01/11/2149761/a-short-history-of-the-bowie-bond/}

Friday, 8 January 2016

Why it’s so difficult to build a hydrogen bomb

{http://qz.com/588519/why-its-so-difficult-to-build-a-hydrogen-bomb/}

Thursday, 7 January 2016

The 20 Percent World

{http://www.bloombergview.com/articles/2016-01-03/the-20-percent-world-iiz31la5}

{http://www.bloombergview.com/articles/2016-01-03/the-20-percent-world-iiz31la5}

Wednesday, 6 January 2016

Monday, 4 January 2016

Lies, Damned Lies and Physics

{http://www.bloombergview.com/articles/2015-12-30/lies-damned-lies-and-physics}

Zuckerberg’s hypocritical war

{http://ftalphaville.ft.com/2016/01/04/2149000/zuckerbergs-hypocritical-war-on-net-neutrality-in-india/}

Zuckerberg’s hypocritical war

{http://ftalphaville.ft.com/2016/01/04/2149000/zuckerbergs-hypocritical-war-on-net-neutrality-in-india/}

Subscribe to:

Posts (Atom)